The Impact of Global Trends on Nigeria’s Mining Equipment Selection for 2025

As the cryptocurrency sector surges forward with relentless momentum, Nigeria finds itself at a fascinating crossroads in 2025, deciding how best to channel global mining trends into practical, profitable ventures. The mining machine landscape is evolving at breakneck speed, and Nigerian enterprises, eager to harness the digital gold rush—Bitcoin, Dogecoin, Ethereum, and beyond—are faced with critical choices. The selection of mining equipment goes far beyond mere hardware specifications; it is a strategic alignment with not only technological innovation but also with shifting global economic currents and regulatory contours. More than just a calculator of hashes, mining rigs have become pivotal instruments in the balance between profitability, sustainability, and scalability.

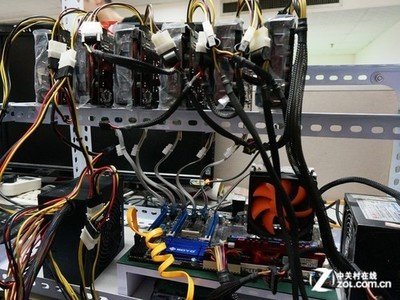

Bitcoin (BTC) remains the undisputed heavyweight in the crypto-mining arena, often dictating the tempo of global mining machine upgrades. Nigeria, with its vast population and increasing internet penetration, is emerging as a significant player in this domain. However, miners here grapple with energy constraints and infrastructural challenges. This makes the selection of energy-efficient and high-output mining rigs critical. Machines that optimize power consumption without compromising on hash rate are not just desirable—they are essential. Innovative ASIC miners, tailored for maximum efficiency in Bitcoin extraction, have seen a surge in demand. Their design improvements, often driven by global competition among manufacturers, influence purchasing decisions across Nigerian mining farms eager to maximize returns amidst power volatility.

Ethereum (ETH) miners in Nigeria watch in anticipation as the cryptocurrency transitions toward proof-of-stake, a shift that fundamentally alters mining demands. While Ethereum’s shift may reduce traditional mining opportunities, it simultaneously pushes attention toward alternative cryptocurrencies—the so-called ‘altcoins’—which often still rely on proof-of-work algorithms. This dynamic diversification forces Nigerian miners to remain agile, balancing investments between versatile GPU-based rigs and specialized ASICs tailored for coins like Ethereum Classic or emerging digital assets. The decision matrix here isn’t static; it fluctuates with global chain updates, market valuations, and competitive mining difficulty.

Dogecoin (DOG), once seen as a mere memecoin, has solidified its foothold, thanks largely to its supportive community and emerging utility cases. In Nigeria, Dogecoin mining, often paired with Litecoin due to their merged mining protocol, presents a cost-effective entry point for newcomers, leveraging versatile mining rig setups. The appeal is evident: relatively lower power consumption, moderate difficulty levels, and the potential for lucrative trading on local and international exchanges. Consequently, crypto mining farms in Nigeria have tailored some operations toward Dogecoin, deploying hybrid mining rigs capable of flexibly switching between coins depending on profitability—a testament to the strategic blending of hardware versatility with market foresight.

Beyond individual cryptocurrencies, the hosting of mining machines represents an emergent and highly disruptive facet of Nigeria’s mining ecosystem. Hosting services offer miners a way to bypass local infrastructural limitations, such as unreliable power grids and security concerns, by installing their rigs in professionally managed data centers. This minimizes downtime and maximizes hash rate uptime—a crucial factor when global mining difficulty intensifies. For Nigerian clients, global hosting services provide access to climate-controlled environments optimized for peak machine performance. The rise of mining farms operating in cold regions, powered by renewable energy sources, underscores a global trend that Nigerian operators aspire to emulate. This hybridization of local expertise and international infrastructural benefits exemplifies a new era of crypto-mining sophistication.

Exchanges also play a critical role in shaping mining equipment strategies in Nigeria. The liquidity and volatility of cryptocurrencies influence the frequency of mining rig upgrades and the selection of coins with the best immediate ROI. Rapid trades, margin opportunities, and staking options offered by exchanges create a dynamic backdrop where miners must constantly evaluate their operations. Nigerian investors and miners leverage these platforms not only to convert mined crypto into fiat but also to reinvest in cutting-edge mining technology. Notably, the interdependence between mining operations and exchange liquidity creates a feedback loop, accelerating the uptake of newer, more efficient mining equipment to stay competitive.

The interplay of global trends—ranging from regulatory pressures to technological breakthroughs—has profound implications for Nigeria’s mining equipment selection. Recent international moves toward greener blockchains highlight environmental concerns, nudging Nigerian miners to prioritize machines optimized for energy efficiency. Next-gen devices featuring chip innovations, liquid cooling systems, and adaptive mining algorithms enable local operations to sustain profitability even as electricity costs fluctuate. Consequently, Nigerian mining farms are evolving from small-scale setups to professionalized entities, ready to compete on the international stage, blending sophisticated miners, smart hosting solutions, and strategic coin selection into a cohesive mining portfolio.

In conclusion, as 2025 unfolds, Nigeria’s crypto-mining industry reflects a kaleidoscope of global inspirations and local realities. The careful curation of mining rigs—whether ASIC or GPU-based—combined with innovative hosting options and smart coin selection enabled by seamless exchange access, charts a promising trajectory. The mining machine purchases and hosting choices made today will resonate through the next decade of Nigeria’s crypto journey, setting the foundation for sustainable growth in an ever-shifting digital economy. For entrepreneurs and tech visionaries alike, the fusion of global trends with local ingenuity signals a bright future for the mining sector, powered by relentless innovation and unbridled ambition.

The article explores how shifting global trends—from technological advancements to sustainability demands—reshape Nigeria’s mining equipment choices in 2025, highlighting economic, environmental, and geopolitical factors that drive unexpected innovations and strategic adaptations in the sector.