Forecasting the Future: Trends in Bitcoin Mining Machine Prices

In recent years, the world of cryptocurrencies has exploded, leading to a profound evolution in various sectors, particularly in cryptocurrency mining. One fascinating aspect of this landscape is the fluctuation of Bitcoin mining machine prices. As interest in digital currencies surges, it becomes imperative to forecast trends in these prices, considering factors such as technological advancements, market demands, and broader economic influences.

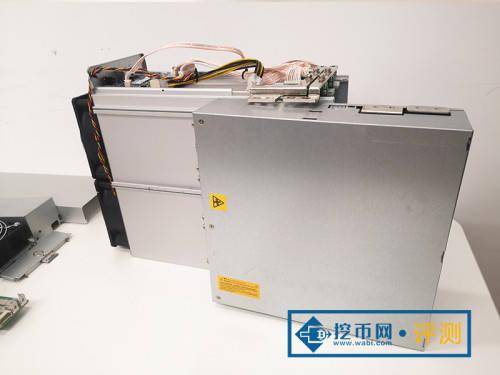

Bitcoin, the pioneer of the vast cryptocurrency market, has set the stage for other coins – like Ethereum (ETH) and Dogecoin (DOG) – to enter and thrive in this dynamic environment. The mining machines powering the network—specifically ASICs (Application-Specific Integrated Circuits)—have become more sophisticated, harnessing advanced technologies that promise higher efficiency and lower power consumption.

As the complexity of Bitcoin mining algorithms increases, so too does the cost associated with mining machines. A typical mining rig doesn’t merely represent a significant upfront investment; it also requires ongoing operational costs, like electricity and cooling systems. Those willing to dive into the mining sector must evaluate their investment against evolving market sentiments and the overall competitiveness of mining infrastructures.

Additionally, market trends signal fluctuating prices for mining machines. Historical data shows that prices often spike during crypto bull runs, fueled by heightened demand from both new and experienced miners. In this climate, many aspiring enterpreneurs turn to mining machine hosting services as an alternative to purchasing their equipment outright. These services offer a wealth of advantages, from reducing the complexity of setup to ensuring optimal operating conditions.

Examining Ethereum’s trajectory reveals a fascinating interaction between its proof-of-stake mechanism and its mining structures. Unlike Bitcoin, which solely relies on traditional mining, Ethereum’s shift may influence the resale value of mining rigs disproportionately. Nonetheless, miners still seek to capitalize on ETH, hoping to take advantage of the currency’s volatilities and attractive staking rewards.

Dogecoin has also garnered unique attention within the crypto community, often seen as a low-entry ticket to the thrilling world of mining and trading. Its friendly and community-driven nature contrasts sharply with the often serious, algorithmically complex strategies adopted for Bitcoin and Ethereum mining. As new miners flock to Dogecoin due to its relatively forgiving mining requirements, the demand for suitable mining machines will undoubtedly influence future price trends.

Thus, as we look forward, a myriad of variables will continue to shape the prices of Bitcoin mining machines. Supply chain issues stemming from global manufacturing slowdowns, geopolitical tensions, and changing regulatory frameworks can create unpredictability. Furthermore, the introduction of cutting-edge innovations in hardware—such as enhanced chip designs or renewable energy solutions—could alter the economics of mining altogether.

Another consideration is the rise of decentralized finance (DeFi) and the potential shifts they may bring to traditional mining practices. If this sector surges, there could be a knock-on effect on the mining landscape, with many miners diversifying their operations or even exiting the Bitcoin space altogether for a more lucrative niche.

In conclusion, predicting the future of Bitcoin mining machine prices is a complex endeavor that intertwines technological, economic, and social factors. As miners and investors navigate this ever-shifting terrain, understanding these dynamics will be crucial. With astute decision-making and a keen eye on market trends, stakeholders can harness the opportunities presented by Bitcoin and its ilk—ensuring they remain ahead in the race for mining supremacy.

This article offers a multifaceted analysis of Bitcoin mining machine prices, exploring technological advances, market demand shifts, and regulatory impacts. It unpredictably combines economic forecasting with environmental concerns, providing a rich perspective on the future dynamics shaping the mining hardware industry.