Is China’s Mining Machine Hosting Price Competitive Globally? An In-depth Review

As the world of cryptocurrencies continues to evolve, the mining sector stands at the forefront of innovation and competition. At the heart of this ecosystem lies the mining machine, an essential tool for anyone wishing to partake in the process of validating transactions and securing networks. Amidst the various regions that host mining operations, China’s prominence often sparks discussions regarding its pricing strategies and competitiveness in global hosting markets. This article endeavors to dissect whether China’s mining machine hosting price stands the test of international scrutiny.

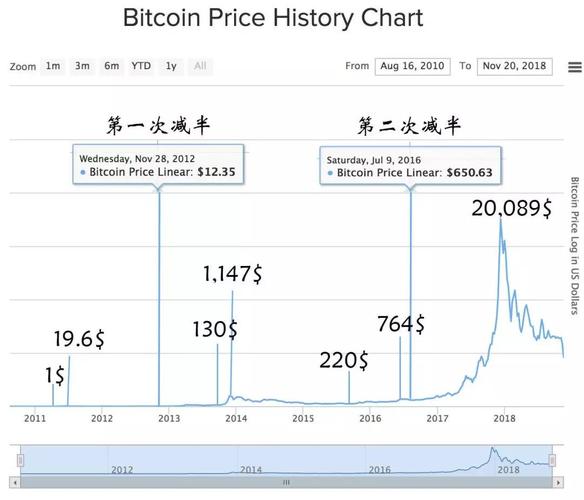

Mining operations are fundamentally driven by the profit margin derived from the rewards of mining cryptocurrencies such as Bitcoin (BTC), Dogecoin (DOG), and Ethereum (ETH). In this dynamic landscape, the cost-effectiveness of hosting services becomes paramount. The growing demand for hash power continuously amplifies the need for accessible mining rig solutions. Consequently, one could argue that the pricing structures set forth by Chinese hosting facilities could either attract or deter potential investors.

One key component influencing pricing is electricity costs, a crucial factor that directly impacts a mining operation’s profitability. China, despite facing regulatory crackdowns in recent years, offers some of the most competitive electricity rates in the world. Regions such as Inner Mongolia and Sichuan, endowed with abundant hydroelectric power, present comparatively lower costs that miners find appealing. Lower energy expenditures naturally translate to higher net profits, prompting mining entities to flock to these opportunities.

Moreover, consider the technological advancements characterizing China’s mining machine production. Homegrown companies like Bitmain and Canaan have consistently spearheaded innovation, fabricating mining rigs that not only enhance efficiency but also provide sizzling speed and low power consumption. Such advancements suggest that with the right equipment, miners can tap into higher yields, further enhancing their competitiveness on a global scale. This raises the question: Are hosting prices reflective of the superior technology that miners gain access to within China?

However, it is essential to address the notion of transparency in pricing. While the allure of low-cost hosting may seem tempting, many small-scale miners often overlook the hidden costs associated with operating in China. These can include administrative fees, logistics for shipping hardware, and potential legal implications stemming from changing regulations. For some, the lure of cost savings may be met with unexpected complexities that could dampen returns. Moreover, the strict regulatory climate creates a volatile environment for operations, compelling miners to adapt swiftly to shifts in policies.

In contrast, regions such as North America and Europe are witnessing a rise in mining activities characterized by regulatory clarity and stability. Here, hosting prices may initially appear higher; however, miners often appreciate the long-term benefits that come from operating in a robust legal framework. This competitive aspect adds another layer of complexity to the analysis of China’s global hosting price competitiveness.

As cryptocurrencies enter the mainstream consciousness, exchanges are also adapting to accommodate an increasing number of miners entering the market. From Bitcoin’s dominant position to Ethereum’s smart contracts, the surge in various digital assets fuels the hunger for robust hosting solutions. The interconnectedness of mining, hosting, and exchanges forms a trifecta that requires a multifaceted understanding of pricing dynamics.

In examining the strengths of China’s hosting prices, it is crucial not to dismiss the larger context of cryptocurrency adoption. Enterprises capable of navigating the volatility associated with crypto markets and regulatory frameworks are equipped not just to survive but to thrive. As miners diversify into emerging digital currencies, the scope of mining machine hosting evolves, compelling several players to consider diverse hosting options that promise returns on investment.

Ultimately, the question remains: Is China’s mining machine hosting price truly competitive on a global scale? The confluence of low electricity costs, advanced technological developments, and an overarching economic environment bolsters China’s standing. Yet, as with any investment, a thorough due diligence process is necessary; miners must weigh not just affordability but also reliability and longevity of operations against the backdrop of market fluctuations and regulatory developments.

In conclusion, while China’s mining machine hosting prices may hold the potential for competitive advantage, a myriad of factors must be considered. Each miner’s experience can be drastically different based on their strategic decisions, understanding of market dynamics, and risk appetite. As the cryptocurrency landscape continues to evolve, one thing remains certain: the quest for the most advantageous hosting environment will persist, driving miners to explore all avenues available both in China and beyond.

A deep dive into China’s mining hosting costs reveals surprising global competitiveness. Beyond cheap power, infrastructure & expertise drive value. Regulatory shifts add intrigue, impacting future dominance. Is the edge sustainable?