Discover Efficient Bitcoin Mining Methods in Singapore’s Thriving Scene

Singapore, a global financial hub, is increasingly becoming a noteworthy player in the cryptocurrency sphere. While direct cryptocurrency trading and adoption are gaining traction, a less visible but equally compelling narrative is unfolding: the rise of Bitcoin mining, albeit with unique adaptations and strategies dictated by Singapore’s particular economic landscape. This article delves into the efficient Bitcoin mining methods being employed in Singapore, exploring the challenges and opportunities that define this nascent industry.

The energy landscape in Singapore presents a significant hurdle for traditional, large-scale Bitcoin mining operations. With limited land and high electricity costs compared to regions like China, Kazakhstan, or North America, setting up massive mining farms, reminiscent of those gargantuan facilities consuming entire towns’ worth of electricity, simply isn’t feasible. Instead, Singaporean entrepreneurs and tech enthusiasts have focused on optimizing efficiency and exploring alternative models.

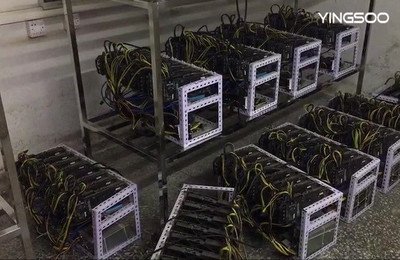

One prevailing strategy revolves around leveraging existing data centers. Singapore boasts a robust and sophisticated data center infrastructure, catering to the needs of multinational corporations and tech giants. These data centers already possess the necessary cooling systems, power infrastructure, and network connectivity required for running ASIC miners, the specialized hardware designed for Bitcoin mining. By colocation within these facilities, miners can bypass the significant capital expenditure associated with building dedicated mining farms from scratch. This approach allows for scaling up operations without incurring prohibitive initial investments.

However, even with colocation, electricity costs remain a primary concern. Singapore relies heavily on natural gas for power generation, which translates to relatively high electricity tariffs. Therefore, efficiency is paramount. Miners are meticulously selecting the latest generation ASIC miners, known for their superior hash rate per watt performance. These devices are significantly more energy-efficient than older models, reducing the overall power consumption and mitigating the impact of high electricity prices.

Beyond hardware optimization, innovative cooling solutions are also being deployed. Traditional air cooling systems, while effective, can be energy-intensive. Immersion cooling, where miners are submerged in dielectric fluid, is gaining traction as a more efficient alternative. This method allows for denser miner packing and improved heat dissipation, further reducing energy consumption and operational costs. Some enterprising miners are even exploring novel approaches to waste heat recovery, aiming to repurpose the heat generated by the miners for other applications, such as heating water or powering absorption chillers. This approach not only reduces energy waste but also contributes to a more sustainable mining operation.

The regulatory environment in Singapore also plays a crucial role in shaping the Bitcoin mining landscape. The Monetary Authority of Singapore (MAS) has adopted a pragmatic and relatively progressive stance towards cryptocurrencies and blockchain technology. While not explicitly endorsing or regulating Bitcoin mining, the MAS has provided clear guidelines on cryptocurrency trading and anti-money laundering (AML) requirements. This regulatory clarity provides a degree of certainty for miners operating within the legal framework and fosters innovation within the industry.

Moreover, Singapore’s highly skilled workforce and vibrant tech ecosystem provide a fertile ground for developing ancillary services related to Bitcoin mining. Companies are emerging that specialize in miner maintenance, repair, and optimization. Others are focusing on developing sophisticated software solutions for monitoring miner performance, optimizing mining pools, and managing energy consumption. This creates a ripple effect, driving innovation and attracting further investment into the Bitcoin mining ecosystem.

The future of Bitcoin mining in Singapore hinges on several factors. Continued advancements in ASIC miner efficiency, coupled with the development of even more innovative cooling solutions, will be critical for reducing operational costs. Exploring renewable energy sources, such as solar power, could also help mitigate the impact of high electricity prices and promote more sustainable mining practices. Finally, a supportive and well-defined regulatory framework will be essential for fostering growth and attracting further investment into the industry. While Singapore may not become a global powerhouse in Bitcoin mining due to its inherent limitations, its focus on efficiency, innovation, and regulatory clarity positions it as a notable player in the evolving cryptocurrency landscape.

Beyond Bitcoin, the principles of efficient mining are applicable to other cryptocurrencies, albeit with varying levels of profitability and feasibility. Ethereum, prior to its transition to Proof-of-Stake (PoS), was a popular target for GPU mining, which, unlike ASIC mining, could be adapted to mine a broader range of cryptocurrencies. While Ethereum mining is no longer possible, the lessons learned in optimizing GPU mining efficiency are still relevant for mining other Proof-of-Work (PoW) cryptocurrencies. Dogecoin, often mined in conjunction with Litecoin using merged mining techniques, could also benefit from efficiency improvements. However, the relatively low value of Dogecoin compared to Bitcoin makes it less economically attractive for large-scale mining operations in a high-cost environment like Singapore.

The prevalence of cryptocurrency exchanges in Singapore provides another avenue for engagement with the digital asset space. These exchanges facilitate the buying, selling, and trading of Bitcoin and other cryptocurrencies. While not directly involved in mining, they contribute to the overall ecosystem by providing liquidity and facilitating price discovery. The presence of reputable exchanges enhances investor confidence and attracts further participation in the cryptocurrency market.

This article unveils cutting-edge Bitcoin mining techniques thriving in Singapore’s dynamic market, blending innovative technology, sustainable energy, and regulatory nuances to maximize efficiency and profitability in one of Asia’s most competitive hubs.